How to use the mining calculator correctly

As Charles de Gaulle said: “Statistics are like a miniskirt: they show everything, but hide the most interesting.” Therefore, using the mining profitability calculator, you should not forget that this is not a predictive or analytical tool but a program code designed to perform mathematical operations to determine possible financial circumstances for given input parameters. And it is in the input data that the whole essence of predicting cloud mining income 2022-2023 lies in.

To work effectively with the indicators of the Hashmart mining calculator, you need to use three methods of analysis: mathematical, historical, and critical. If at least one of the analytical methods creates an objectively favorable environment for you to enter the cloud mining market, you can safely start a phased investment. As a rule, market volatility in a long investment period can be neglected: deviation extremes will average the market in your favor.

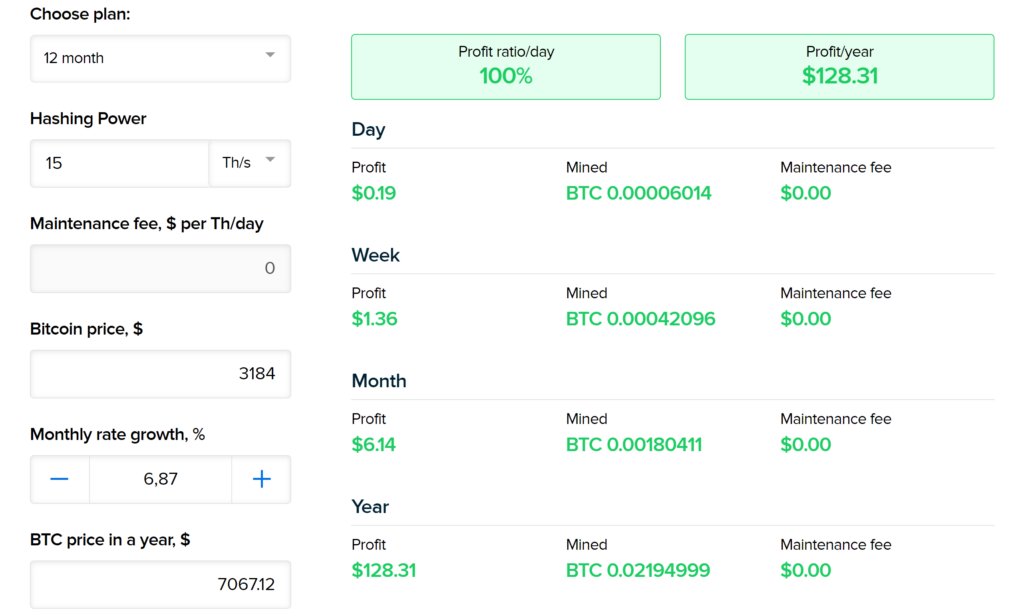

Let’s look into each of the analysis methods and try to predict the effectiveness of cloud mining when buying a fixed-term contract for bitcoin mining with a capacity of 15.0 Th/s for 24 months with input parameters set for September 20, 2022, namely:

The cost of 1 BTC is $18,974.74;

The average world cost of electricity is $0.137 per kWh;

Depreciation cost for mining Hashmart – $0.03 per Th/day;

Hashmart equipment maintenance costs – $0.15 per Th/day.

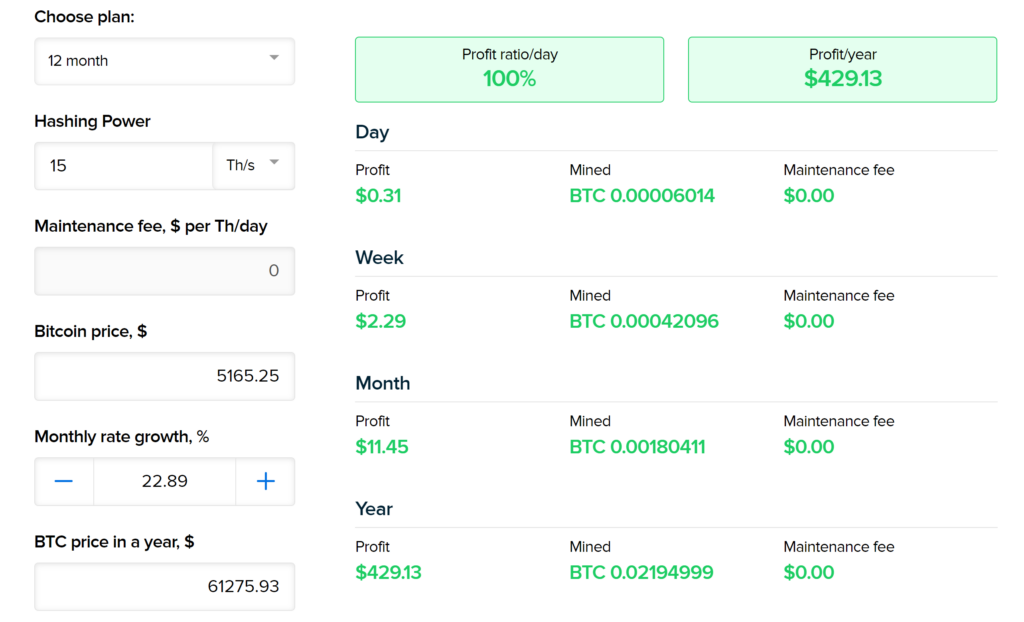

A mathematical method for data analysis of Hashmart cloud mining profitability calculator

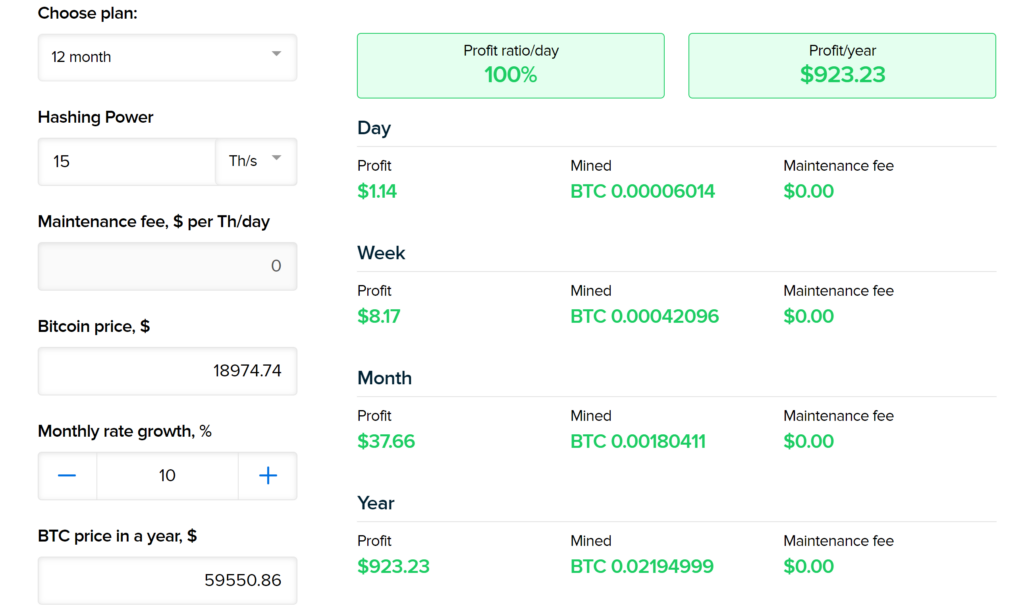

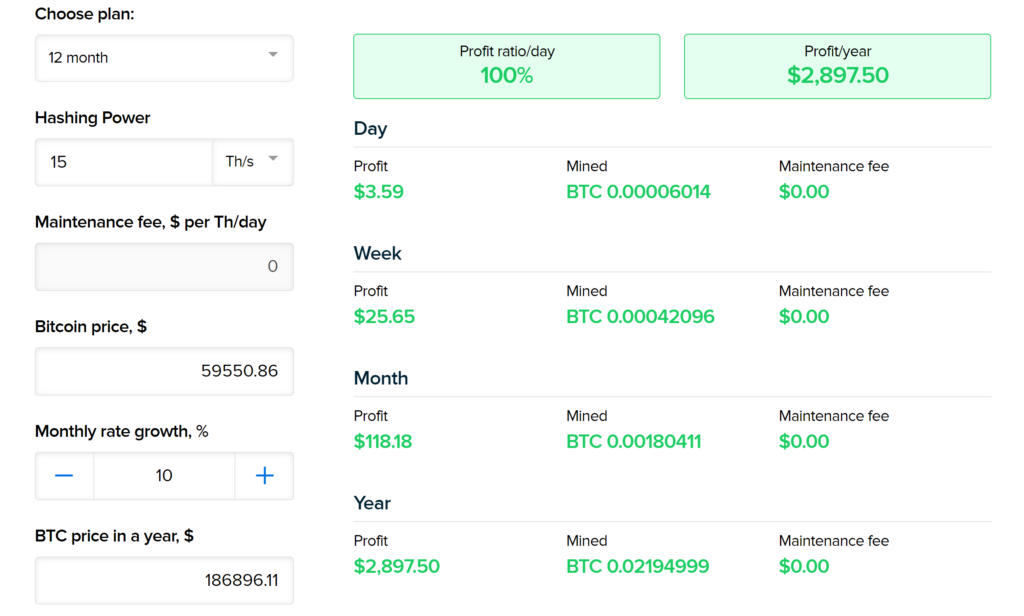

The most straightforward, precise, and therefore inefficient method of analysis, since it takes into account only the current state of the market, does not assess the dynamics of market changes, and does not use correlation coefficients. Nevertheless, it is the mathematical method that gives the primary picture, and if it predicts the return on investment, then other methods for evaluating investments in cloud mining can no longer be used. As of September 20, 2022, the profitability calculator from the Hashmart provider, with a predicted rate growth of 10% monthly, shows the following figures:

The first year profit

The second year profit

At the output, we see $923.23 first year of income and $2897.50 in the second year, or a total return of $3820.73. For a mathematical evaluation of investments, let’s turn to the current value of the contract on the given conditions with the cloud mining operator Hashmart:

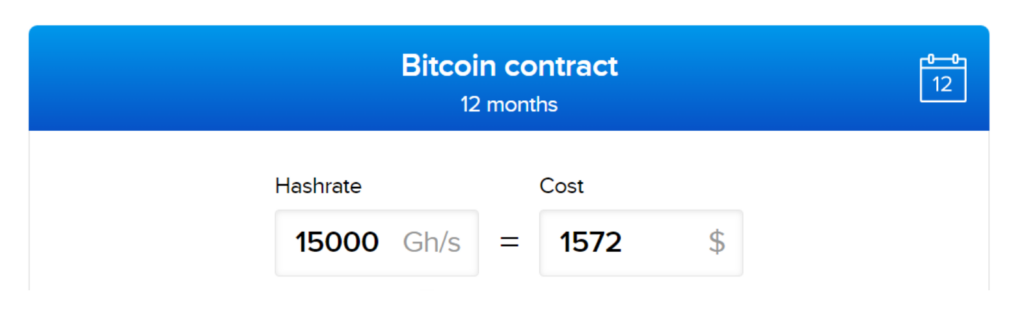

Thus, the cost of purchasing a contract for 24 months will be $3144. And the absolute profit will be equal to $3820.73 – $3144 = $676.73, or $18.9 of the starting costs (9.45% per annum). Such figures are quite modest indicators of return on investment, although they show the effectiveness of investments. Therefore, we turn to the two remaining analysis methods to help decide.

A historical method of analysis

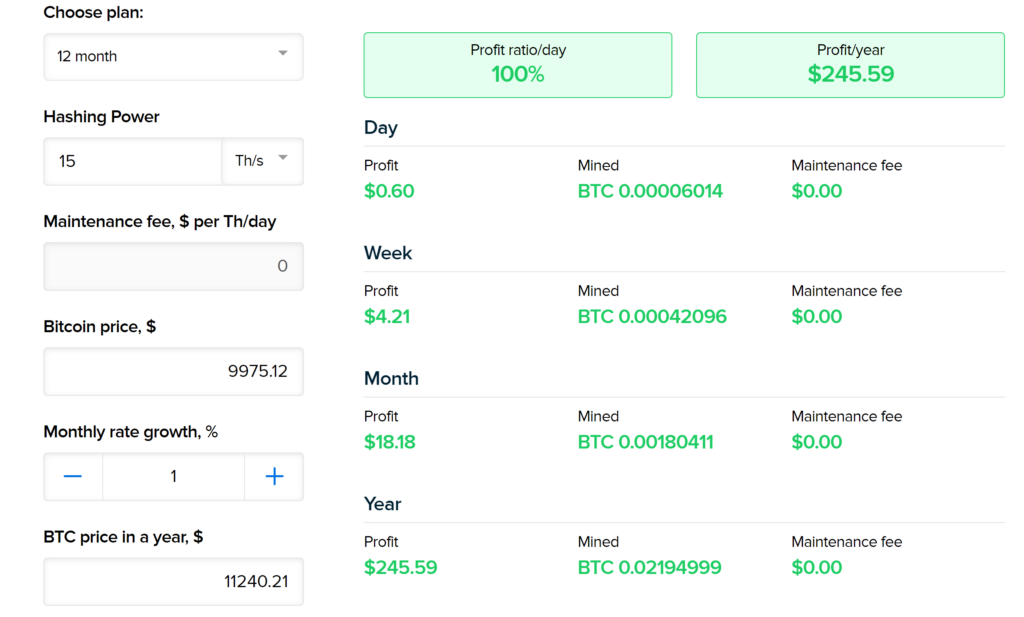

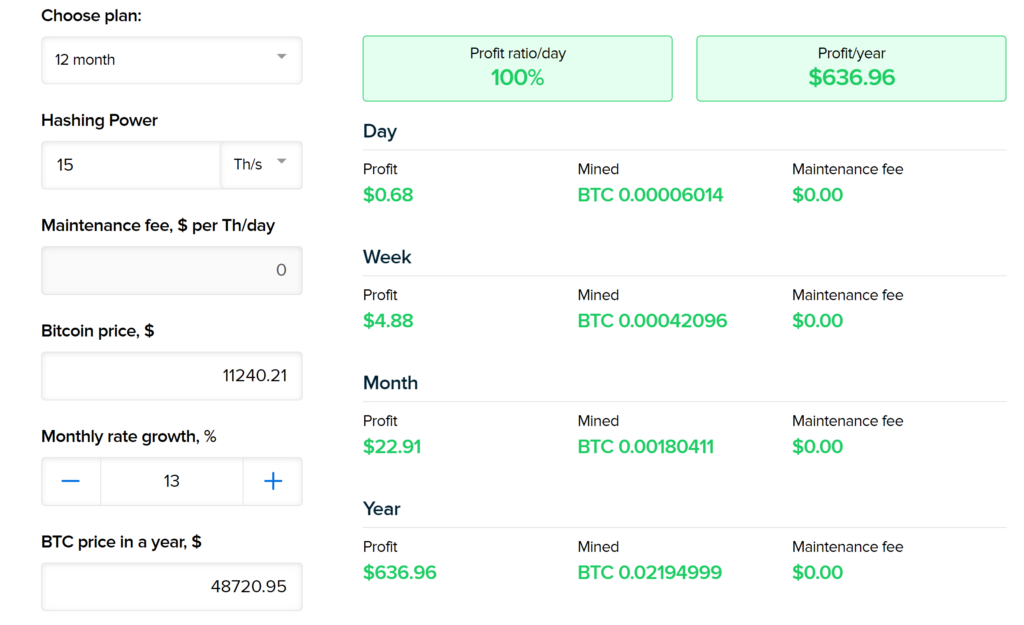

To evaluate by the historical method, let’s turn to the history of BTC exchange rate changes and Hashmart payments. Consider the prospects for acquiring the same capacity three years ago, on the same day, September 20, 2019. In those days, the market was bullish and did not yet know that in 5 months, it would drop three times due to COVID-19. The cost of 1 BTC was $9975.12, and the situation was similar to the current one since no growth prerequisites were foreseen. The cost of 15 Th/s was $672. A year later, the price of 1 BTC rose to $11,080, and a year later – to $48,213.44. Projecting such a historical picture into the Hashmart cloud mining profitability calculator, we see the following:

1st year

2nd year

Total income with current depreciation would be $664. However, we know that depreciation costs were also lower in 2019-2021, and the mining calculator calculates income at the current BTC value on September 20, 2019, and not on the planned September 19, 2022. Given the growth of BTC quotes by five times, the actual absolute income would be $3320, and the real profit would be $2648. And this is without taking into account the correlation in depreciation costs. Thus, the historical analysis method shows us that we will not only be able to take profits but also win significantly if we prefer Hashmart cloud mining to a classic cryptocurrency holding.

Critical analysis method

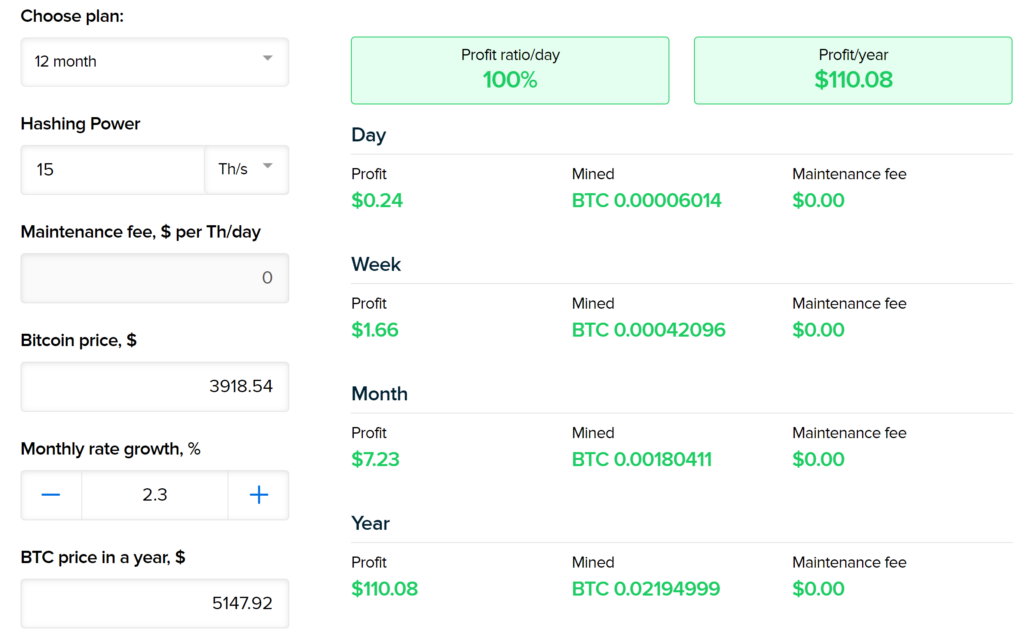

This method involves finding the two highest extremums of the rise and fall of the BTC value and projecting them into the profitability calculator. Starting from April 2017, when Hashmart satisfied the needs of the first customers (the exchange rate was $1184.5) and up to the present day, the following periods have been the most extreme:

March 13, 2019 ($3918.54 per 1 BTC) – March 12, 2021 (61283.20 per 1 BTC)

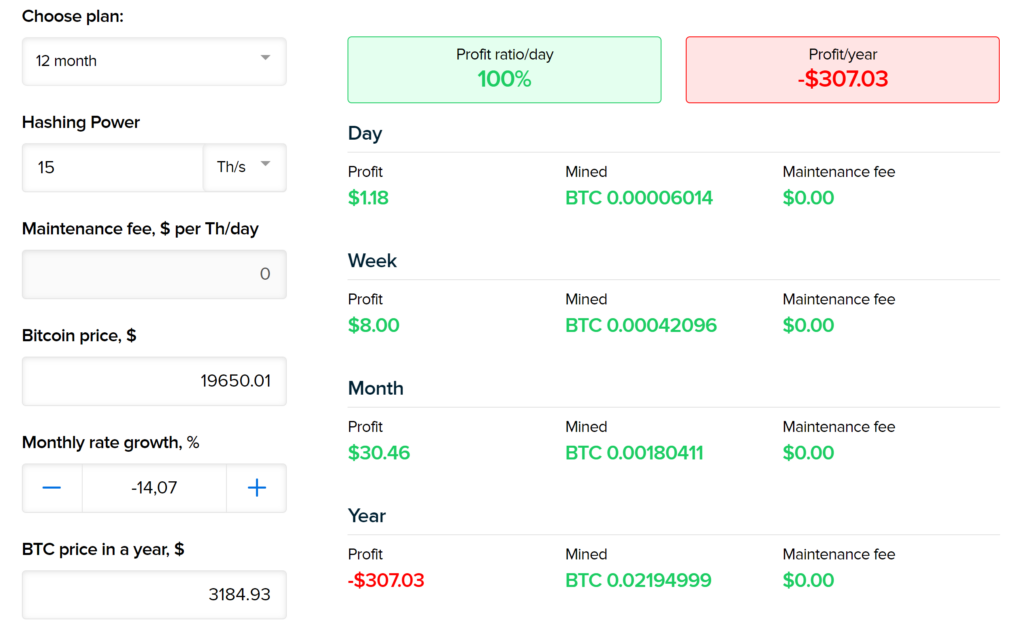

December 15, 2017 (19650.01 for 1 BTC) – December 14, 2019 ($7069.92 for 1 BTC)

Add the data into the Hashmart mining profitability calculator. Changes in depreciation costs are neglected.

Then the maximum critical income at the cost of $310 per 15 Th/s is:

1st year

2nd year

The maximum critical revenue from cloud mining would be $528 in 2019 prices, or $218. However, the actual growth of the BTC rate during this time amounted to 1564%, which means that on March 12, 2021, the total income would be $8258, or 2664% of the initial investment. This amount significantly exceeds the yield of the holding and makes investments in Hashmart short-term contracts profitable.

Now let’s calculate the maximum critical loss when investing in a short-term contract for 24 months on December 15, 2017 (cost 15 Th/s – $891):

1st year

2nd year

The total loss would be $775, but in relative terms, such losses are inconspicuous before the maximum critical profit.

Based on the above analysis, we can conclude that purchasing futures cloud mining contracts is profitable and expedient even in a falling or unstable market. We recommend making a one-time large capacity purchase at the predicted market surge. To flatten the yield curve, distribute your investments in small amounts over the calendar, making capacity purchases daily, thereby leveling the risks of critical lower extremes.